December 1, 2024 - 12:26

The incoming Trump administration is making waves with aggressive policies that could significantly impact the U.S. economy and stock market. Among its immediate priorities are mass deportations of undocumented immigrants and the potential to instigate a global trade war. These actions are generating uncertainty in financial markets, as traders grapple with the implications for economic stability.

As tensions escalate in various parts of the world, including ongoing conflicts in Europe and the Middle East, bond traders are adjusting their strategies. There is a noticeable shift away from bets on lower interest rates, as concerns mount over a possible resurgence of inflation in the U.S. economy.

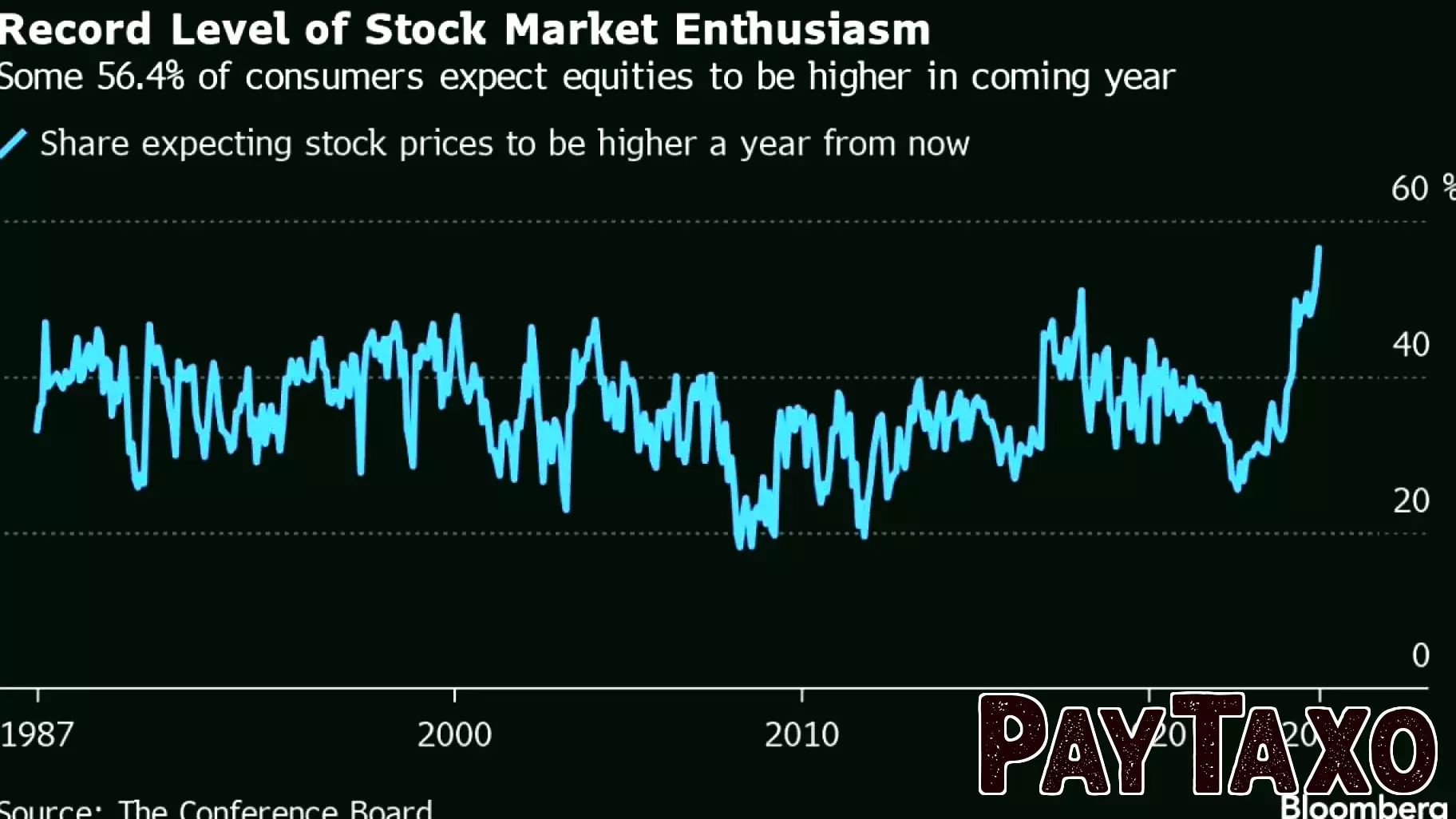

The combination of these factors raises alarms among economists and market analysts, who warn that the bullish stock market could be at risk of inflating into a bubble. Investors are urged to remain cautious as the new administration's policies unfold, potentially reshaping the economic landscape in the months ahead.