April 11, 2025 - 11:02

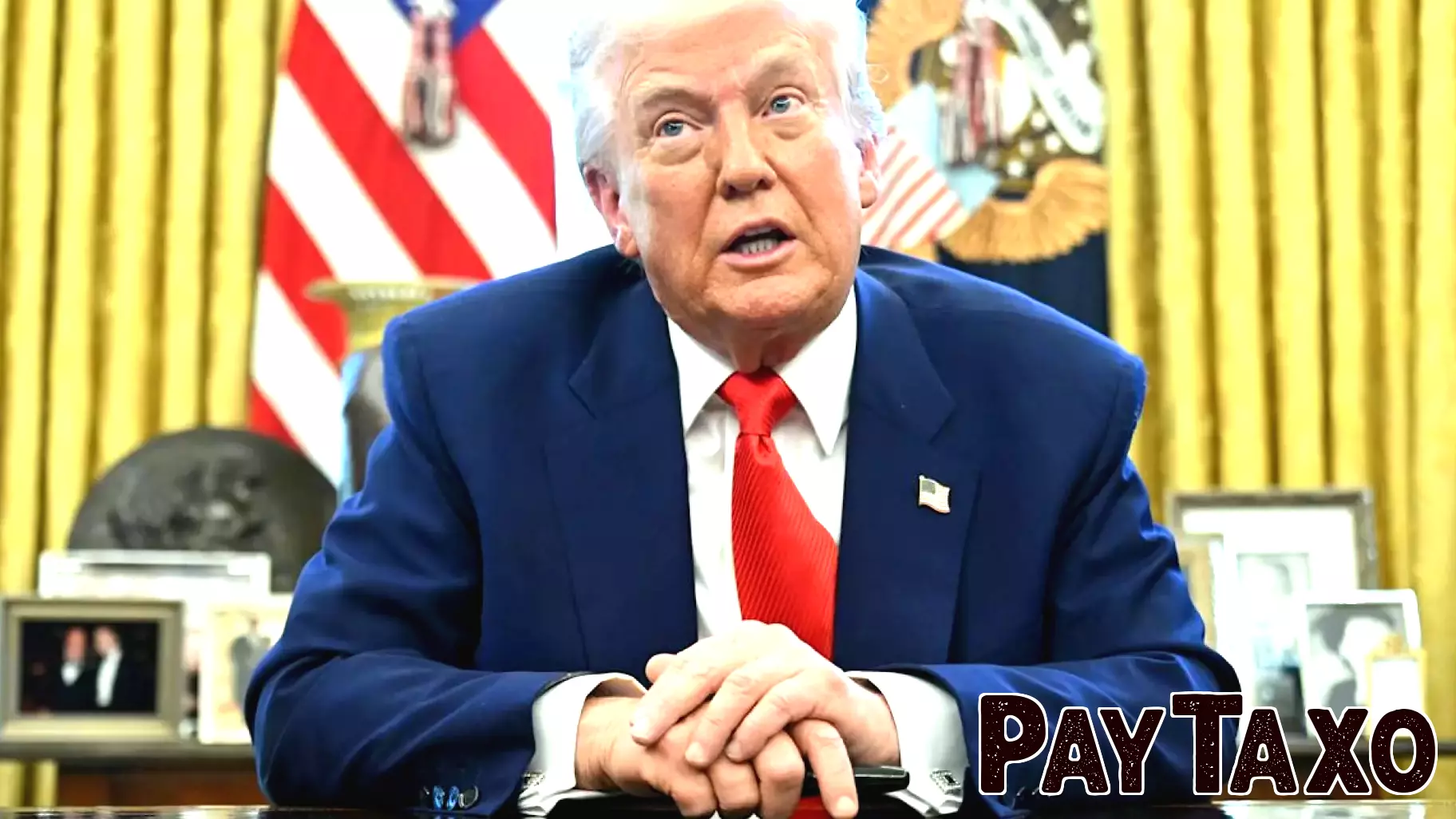

President Trump has decided to halt the implementation of reciprocal tariffs, a move that many analysts attribute to the pressures exerted by the bond market. This unexpected pause signals a significant shift in his administration's trade strategy, highlighting the intricate relationship between financial markets and political decision-making.

As bond yields fluctuated in response to ongoing trade tensions, the potential economic repercussions became more pronounced. Investors grew increasingly anxious about the impact of tariffs on economic growth, leading to a decline in bond prices. This reaction from the market likely played a crucial role in shaping Trump's decision to reconsider his stance on tariffs.

In a statement, Trump acknowledged the influence of market dynamics, stating, "I was watching it." His admission underscores the reality that economic indicators can sway political leaders, especially in an environment where trade policies are closely linked to market stability. The bond market's reaction may have ultimately prompted a strategic retreat from aggressive tariff measures, illustrating the power of financial markets in shaping policy outcomes.