April 18, 2025 - 12:55

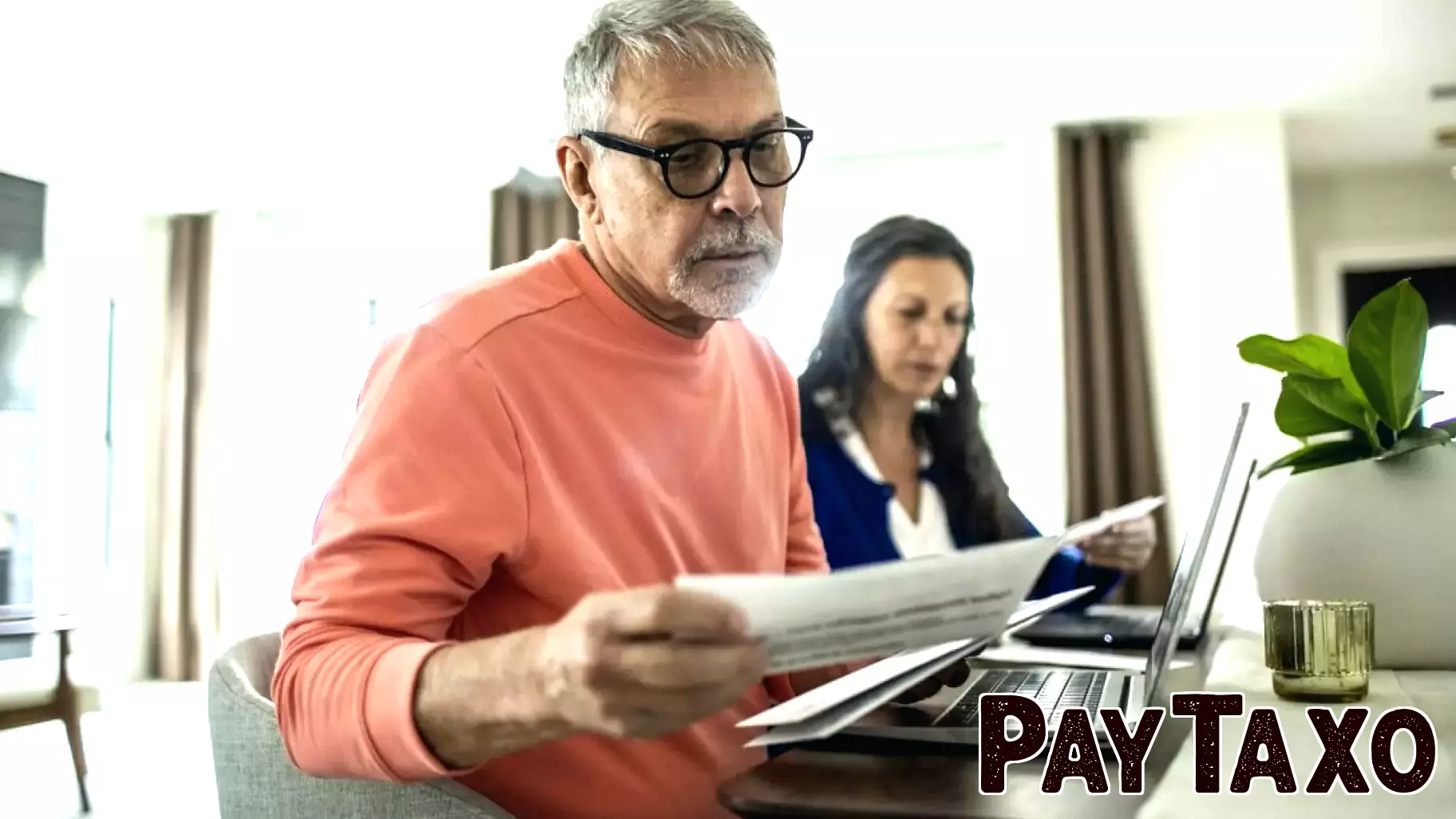

Now that another tax season is in the rearview mirror for most of us, it's a great opportunity to reflect on what we've learned about our finances and how we can better prepare for the future. Here are four key takeaways that can help you boost your financial health moving forward.

Firstly, understanding your deductions and credits can significantly impact your tax bill. Many taxpayers miss out on potential savings simply because they are unaware of available options. Keeping thorough records throughout the year can help ensure you don’t overlook anything.

Secondly, consider the benefits of tax-advantaged accounts, such as IRAs or HSAs. These accounts not only help you save on taxes now but also contribute to your long-term financial goals.

Thirdly, reviewing your withholding can prevent surprises next tax season. Adjusting your W-4 can help you find the right balance between your take-home pay and tax obligations.

Lastly, using tax season as a prompt for broader financial planning can set you up for success. Whether it’s budgeting, saving for retirement, or paying down debt, the insights gained during tax preparation can be invaluable for making informed decisions in the coming year.