December 24, 2024 - 02:50

In a notable shift in the stock market, the Nasdaq and S&P 500 indices experienced significant gains, largely driven by the impressive performance of Nvidia and other semiconductor stocks. This surge comes as investors grapple with the Federal Reserve's recent signals regarding interest rates, suggesting that they may remain elevated for an extended period.

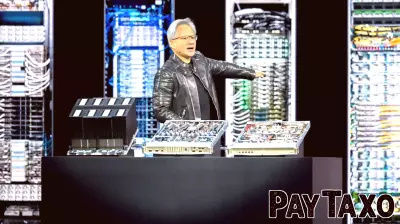

Nvidia's strong earnings report and optimistic outlook bolstered investor confidence, leading to a rally in tech stocks that has become a focal point of market activity. The broader implications of the Fed's stance on interest rates have sparked discussions among analysts and traders alike, as they assess how prolonged higher rates might impact economic growth and corporate profitability.

As the market reacts to these developments, investors are closely monitoring the tech sector, which has shown resilience despite economic uncertainties. The performance of chip manufacturers, in particular, underscores the ongoing demand for technology and innovation in an increasingly digital world. The interplay between interest rates and stock performance will remain a critical topic as market participants navigate the coming months.