December 2, 2024 - 12:51

US exchange-traded funds (ETFs) focused on Bitcoin and Ether are experiencing a surge in demand, reaching unprecedented levels. This remarkable growth comes in the wake of President-elect Donald Trump’s commitment to reduce regulatory barriers for the cryptocurrency sector.

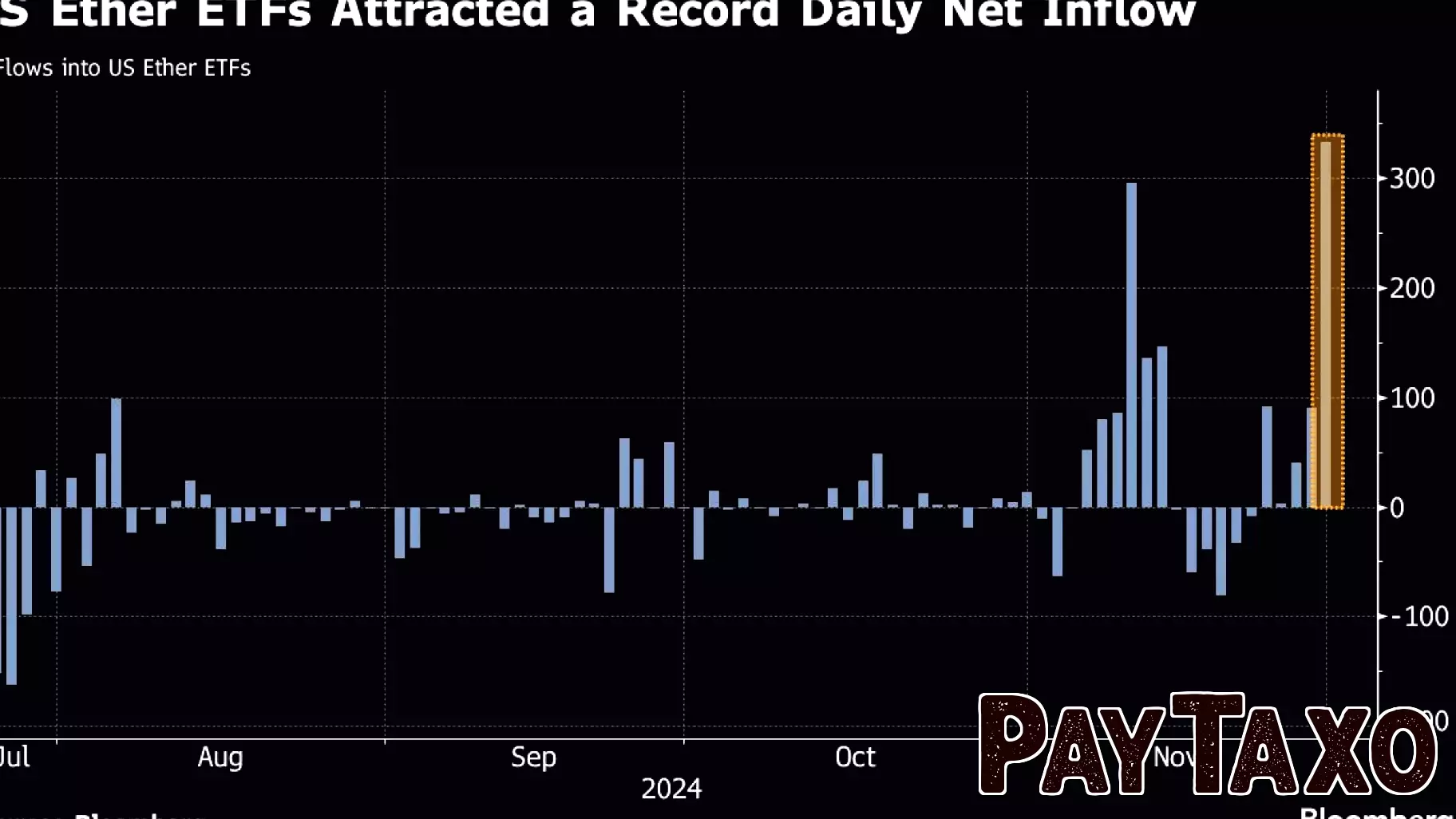

In November alone, Bitcoin ETFs saw net inflows totaling $6.5 billion, while Ether ETFs recorded an impressive $1.1 billion in inflows. This influx of capital reflects growing investor confidence in cryptocurrencies, driven by an increasingly favorable political climate.

The significant interest in these digital assets highlights a broader trend as more investors seek exposure to the rapidly evolving cryptocurrency market. With the promise of a more accommodating regulatory environment, many believe that the potential for growth in the crypto space is just beginning.

As the landscape continues to shift, the performance of Bitcoin and Ether ETFs will be closely monitored, as they may serve as barometers for the overall health of the cryptocurrency market in the coming months.