January 30, 2025 - 13:33

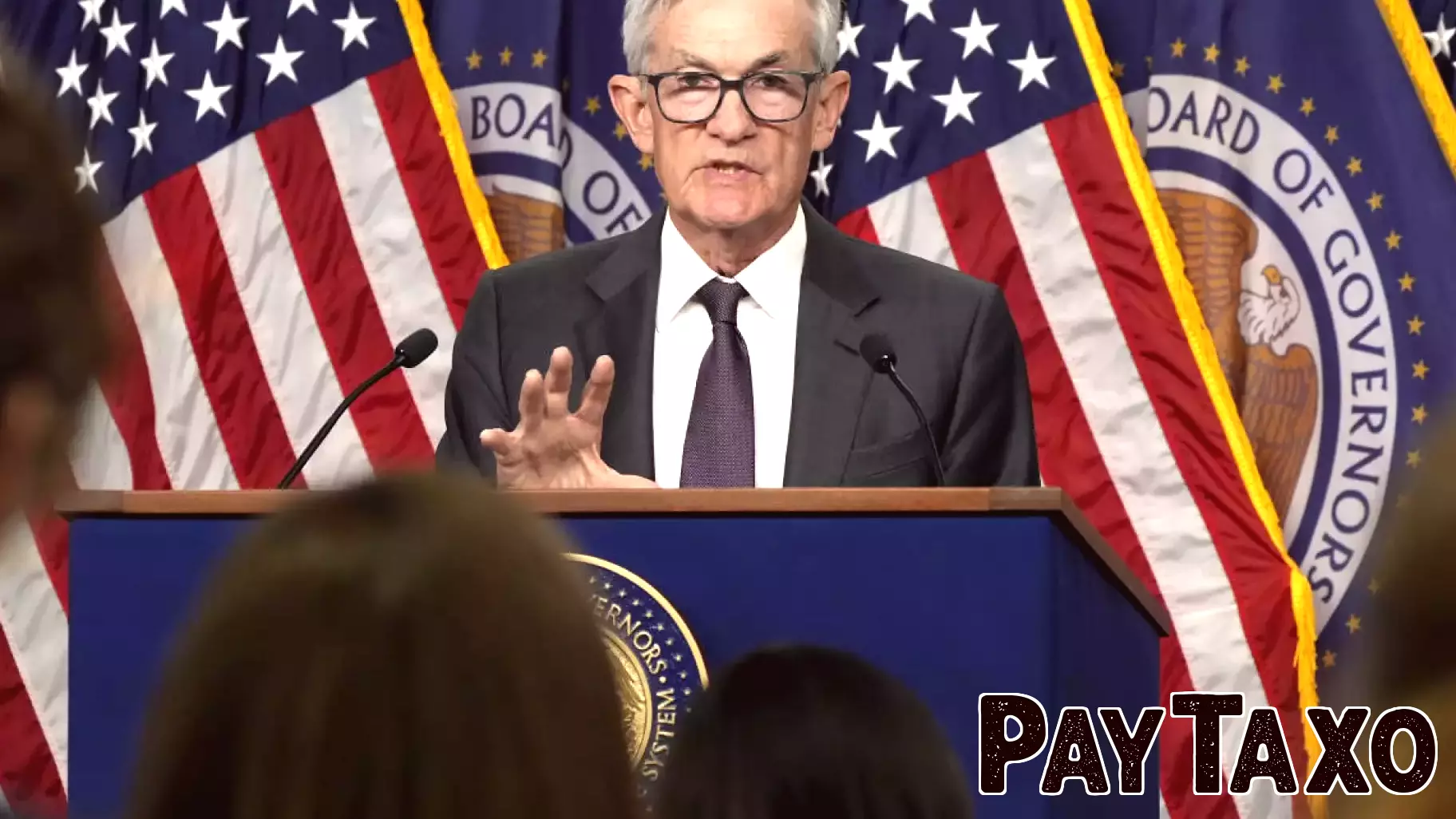

In a climate of economic unpredictability, Federal Reserve Chair Jerome Powell has made a decisive move by maintaining interest rates, signaling a commitment to his mandate. This decision comes during a period marked by significant challenges, including inflationary pressures and fluctuating market conditions. Powell's stance is seen as a protective measure, ensuring that the Federal Reserve remains focused on its core objectives of fostering maximum employment and stabilizing prices.

By holding rates steady, Powell aims to provide a sense of stability to both consumers and investors, countering fears of an economic downturn. His approach reflects a careful balancing act, as he navigates the complexities of current financial dynamics while remaining vigilant against potential risks. As the economy continues to evolve, Powell's leadership will be crucial in guiding the Federal Reserve's policies and maintaining confidence in the financial system. This steadfastness underscores the importance of a measured approach in times of uncertainty, reinforcing the Fed's role as a key player in economic stability.