March 14, 2025 - 14:35

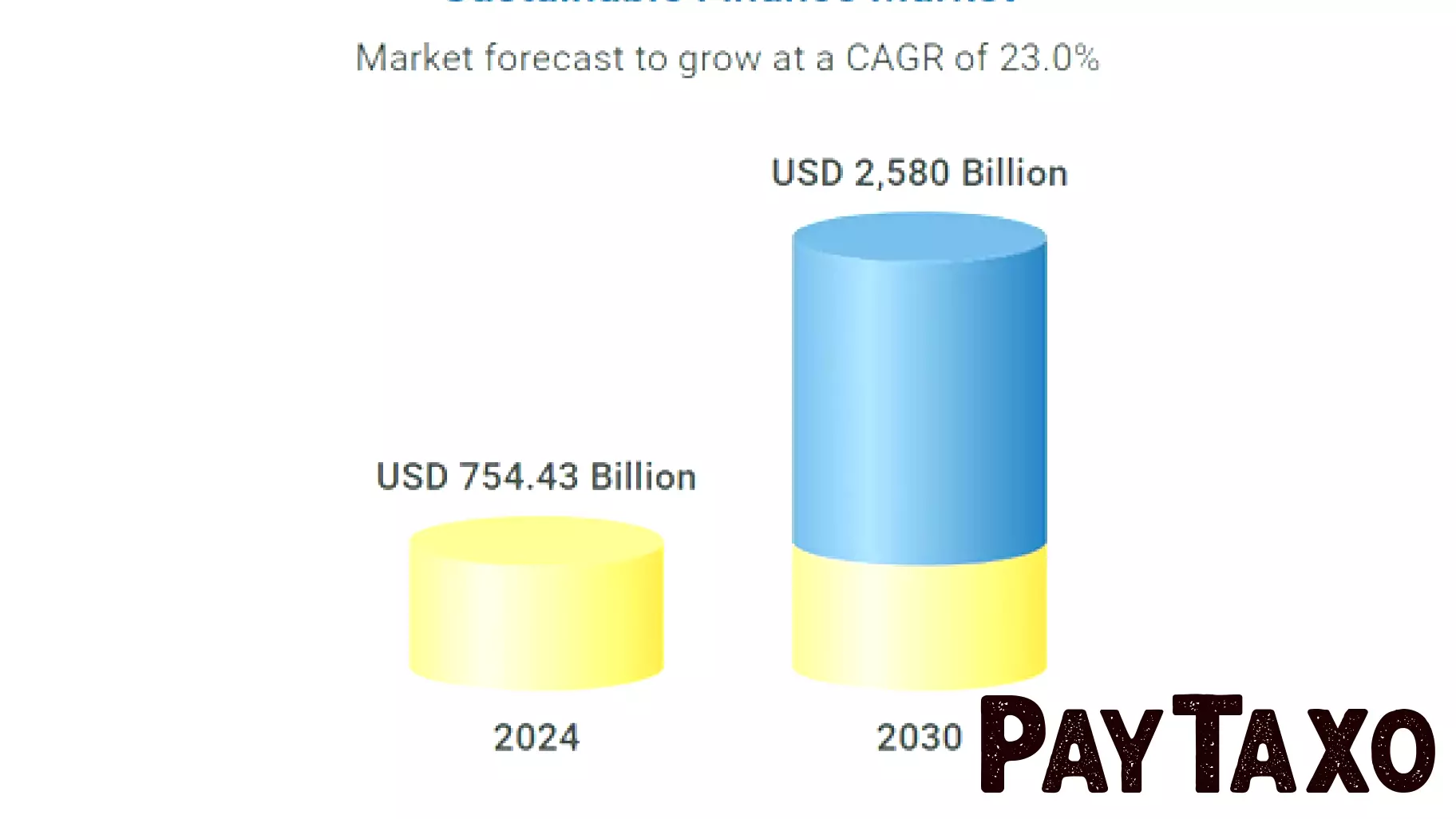

The sustainable finance sector is on a remarkable growth trajectory, with projections indicating a surge from USD 754.43 billion in 2024 to an impressive USD 2.58 trillion by 2030. This expansion is driven by increasing awareness of environmental, social, and governance (ESG) factors among investors and companies alike.

Key trends influencing this market include a heightened focus on responsible investing, integration of sustainability into financial decision-making, and the development of innovative financial products tailored to meet the demands of eco-conscious investors. Equity, bond markets, exchange-traded funds (ETFs), and alternative investments are all expected to play significant roles in this evolution.

Major financial institutions are taking note, with industry giants actively participating in shaping the sustainable finance landscape. Companies such as BlackRock, State Street Corp., Morgan Stanley, UBS, and JPMorgan Chase & Co. are leading the charge, offering a variety of sustainable investment options and strategies to cater to the growing demand.

As the sustainable finance market continues to mature, it presents significant opportunities for investors and companies committed to making a positive impact on society and the environment.